Chat dengan kami disini

After previously, successfully getting the title of The Best Digital Brand, this time BPR Lestari Bali again managed to maintain a satisfactory report card in terms of business performance. In the 10th Infobank BPR Awards event last Friday (08/30) at the Merilynn Park Hotel Jakarta, BPR Lestari Bali managed to carve the title "Very Good" in the BPR category with assets of Rp 1 Trillion and above. BPR Lestari Bali successfully defended this title for 10 years in a row, starting from 2010.

Luh Ketut Citarasmini, Compliance Director of BPR Lestari Bali when he was presently receiving the award revealed that this award is a form of appreciation for BPR Lestari Bali as one of the businesses people in the banking world, especially BPR. "This award further spurs us to continue to provide the best" added Cita.

This excellent performance is reflected in the growth of BPR Lestari Bali's business in the second quarter of 2019. Noted, the growth of BPR Lestari Bali's assets is at Rp 1.1 Trillion or growing 24% year on year (YoY) in the second quarter of this year. Not only that, but the encouraging achievement was also shown from the declining credit risk (NPL), which is currently recorded at 2.41%, smaller than the average national banking NPL recorded at 2.57% in April 2019. "What what we have achieved so far is certainly inseparable from the support and trust of customers and the public. This is our provision and responsibility to continue to maintain and even continue to improve the quality of our services, "added Cita.

As additional information, at this event, several BPRs under the auspices of the Lestari Group also received "Very Good" performance awards from the Infobank Awards in their respective categories. In this award, BPR Lestari East Java and BPR Lestari Banten won the title in the category of BPR with assets of 100-250 billion while BPR Lestari in Central Java and BPR Lestari Jabar received the title in the category of assets of 50-100 billion.

Tren harga emas global dan domestik yang terus menguat menarik perhatian publik akhir - akhir ini. Aset logam mulia ini kembali mencuri perhatian pelaku pasar dan masyarakat umum seiring... Read More

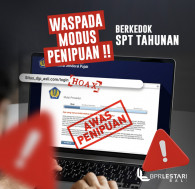

Memasuki periode pelaporan SPT Tahunan, aktivitas penipuan digital yang mengatasnamakan Direktorat Jenderal Pajak meningkat signifikan. Pelaku memanfaatkan kepanikan wajib pajak dengan pesan yang... Read More

Sebentar lagi bulan Januari akan berakhir, yang artinya Anda perlu mulai bersiap. Biasanya, akan semakin banyak postingan “kode” dari pasangan yang muncul. Yup, bulan Februari memang... Read More