Chat dengan kami disini

Gold becomes one of the most sought after investments cause its good liquidity and easy to convert into cash if needed at any time. Its good liquidity makes gold a suitable alternative long-term investment choice. Do you want to invest in gold, but not sure where to start? The following are gold investment tips for beginner.

1. Determine the Goal and Period of Gold Investment

The first thing to do before investing is to determine in advance what the goal of investing in goal is. For example, You want to invest for wedding expenses, children’s education, or retirement savings. If have found the purpose of investing, next You can determine the time period for investing. Adjust the time period of investment with when Your goal is to be achieved.

2. Pay Attention to the Gold Price

Before deciding to buy gold, also need to pay attention to the price of gold at that time. The price of gold also tends to be stable. Even if there is change of price, the change is also not too significance. But it is a good idea to buy gold when the price is down to maximize Your profits in the future.

3. Pay Attention to Where to Invest Gold

If want to invest in gold, need to pay attention to where You buy gold. Choose trusted and experienced place in handling investment or saving and of course the one that best suits Your needs.

4. Start from a Small Nominal

For some people, the current gold price can be said quite high and hard to reach. Not a few people are reluctant to invest in gold because they have to collect a certain amount of money to be able to start investing in gold. However, now this is no longer the case! Investing in gold does not need to be in large amounts because now there are many services that allow You to invest in gold from small capital. One of gold investments that can be started with small capital is Cicil Emas in BPR Lestari.

Cicil Emas can be started from 100 thousand rupiah with a variety of gram option start from 10gr to 1000gr. The period of time of Cicil Emas is also flexible, it can be repaid in installments of up to 10 years so it can be an alternative for long-term investment. Repayment can be made at any time and penalty free! Let’s Cicil Emas now and prepare funds for Your future.

Tren harga emas global dan domestik yang terus menguat menarik perhatian publik akhir - akhir ini. Aset logam mulia ini kembali mencuri perhatian pelaku pasar dan masyarakat umum seiring... Read More

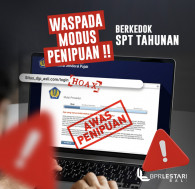

Memasuki periode pelaporan SPT Tahunan, aktivitas penipuan digital yang mengatasnamakan Direktorat Jenderal Pajak meningkat signifikan. Pelaku memanfaatkan kepanikan wajib pajak dengan pesan yang... Read More

Sebentar lagi bulan Januari akan berakhir, yang artinya Anda perlu mulai bersiap. Biasanya, akan semakin banyak postingan “kode” dari pasangan yang muncul. Yup, bulan Februari memang... Read More